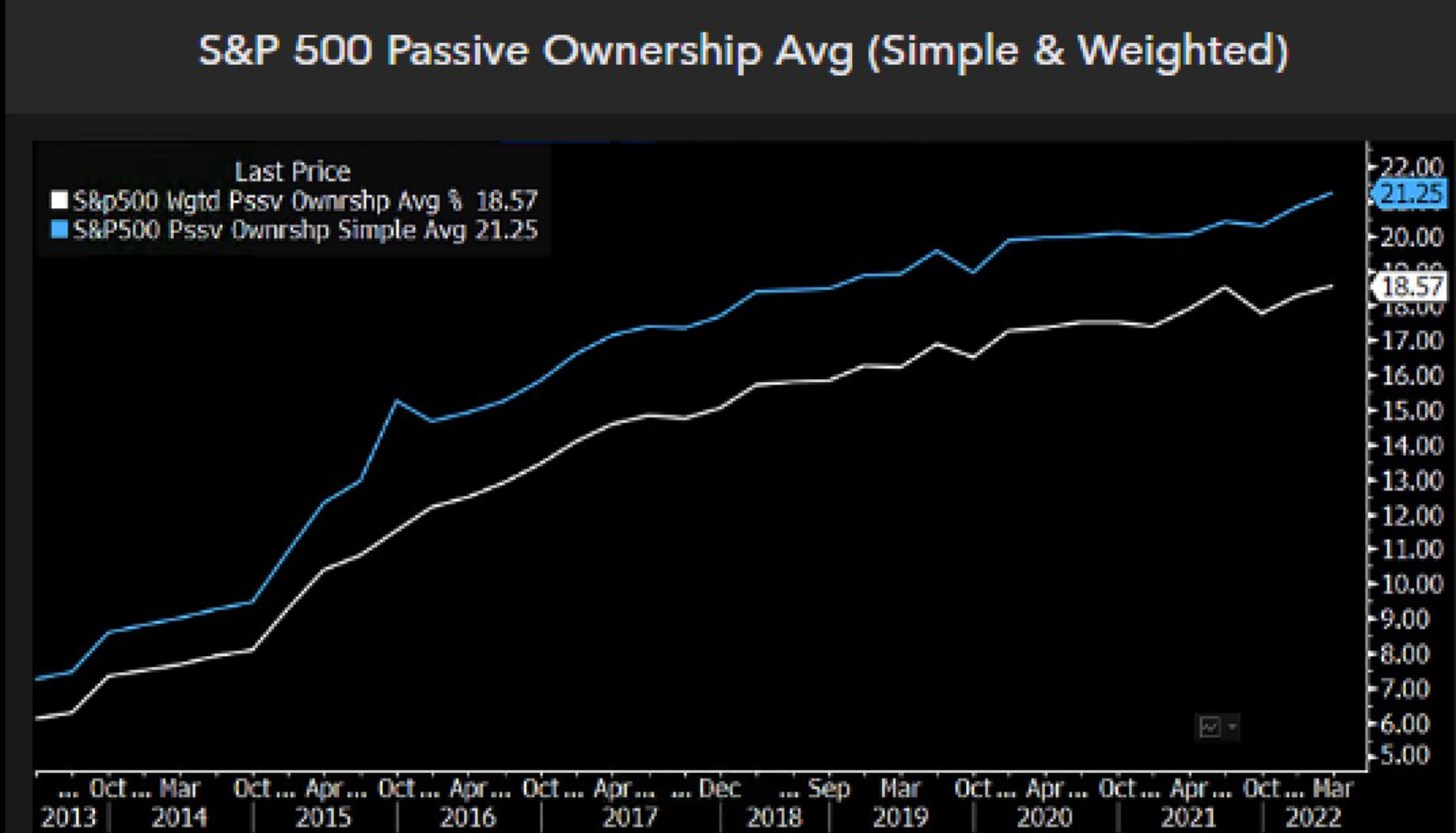

New data shows passive funds’ average stake in S&P 500 constituents has doubled in just seven years – a sign of just how much the index investing thesis has resonated with investors across the world.

According to Bloomberg Intelligence, the average company in the S&P 500 had around 21.2% of its stock owned by passive vehicles such as index-tracking ETFs and mutual funds by the end of March. Even on a weighted average basis, passives are said to own an average stake of 18.6% in US large-cap names.

Source: Bloomberg Intelligence

This trend chimes with separate data from the Investment Company Institute, which suggested passive ownership of all Wall Street stocks doubled over the past ten years. Meanwhile, the share of the US stock market owned by active funds fell from 20% to 14% over the same period, the report said.

Naturally, this trajectory has not occurred without reason. The idea of buying the market – or a stylised slice of a market – at low cost and capturing diversified and rules-based exposures is an appealing prospect that serves at least some role in most investors’ portfolios.

Also, S&P Dow Jones Indices’ most recent SPIVA Europe scorecard shows 94.9% and 94.7% of euro and sterling US equity funds were outperformed by the S&P 500 over the 10 years to the end of 2021, so it should be little wonder investors have been happy to accept benchmark returns when most active candidates have struggled to outperform over longer periods.

The parsimonious case for ‘buying the market’ and the impressive returns of the past 10 years may be too good to last in the long term, however, while history tells us free lunches are rare and often have an expiry date.

Back in 2019 when ETF assets were just half of what they are today, Scion Capital and ‘Big Short’ investor Michael Burry told Bloomberg the growth of ETFs reminded him of the bubble in synthetic asset-backed collateralised debt obligations (CDO) prior to the Global Financial Crash of 2008, because price-setting is driven by massive capital flows rather than fundamental security-level analysis.

Supporting the case that passives create inefficient markets, recent research from the Universities of California and Minnesota argued stock market elasticity – how reactive share prices are to supply and demand – fell by -35% between 2004 and 2016, with the rise of passive investing alone accounting for a 15% decline.

The market-moving power of indices was also illustrated in another study by the Universities of California and Stavanger this year, which reflected on past research showing between 1976 and 1983, stocks gained an average of 2.8% on the day their inclusion in the S&P 500 was announced. Another reported stocks included in the S&P 500 bounced 3.1% the day after their entry was announced between 1989 and 1994.

More recently, a 2011 study revealed stock valuations soar 8.8% in the time between S&P 500 entry being announced and a company actually joining the benchmark. Meanwhile, excluded stocks would fall by an average of 15.1% between announcement and enactment days.

Issuing a warning in his research last year, StoneX Group economist and global strategist Vincent Deluard said: “For now, money will keep flowing into index funds, whether we like it or not.

“At the same time, bubbles, like stars, eventually collapse under their own gravity,” he said.

The sheer scale and pace at which passive vehicles begin materially owning the market also rightly raises questions about their decision-making power – and whether they are the most effective stewards of capital.

Speaking to ETF Stream last year, author of Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever, Robin Wigglesworth, said investors need to be concerned about the "inevitable endpoint of the economics of indexing".

“The scale nature of the index industry means the big will naturally get bigger and barring any unforeseen regulatory intervention, BlackRock and Vanguard are going to become even more titanic than they are today,” Wigglesworth said.

“At some point, they will control the majority of the votes of every major company in the US and globally. This will be one of the defining battlegrounds for index funds and ETFs in the coming decade given the trend shaping the market today.”

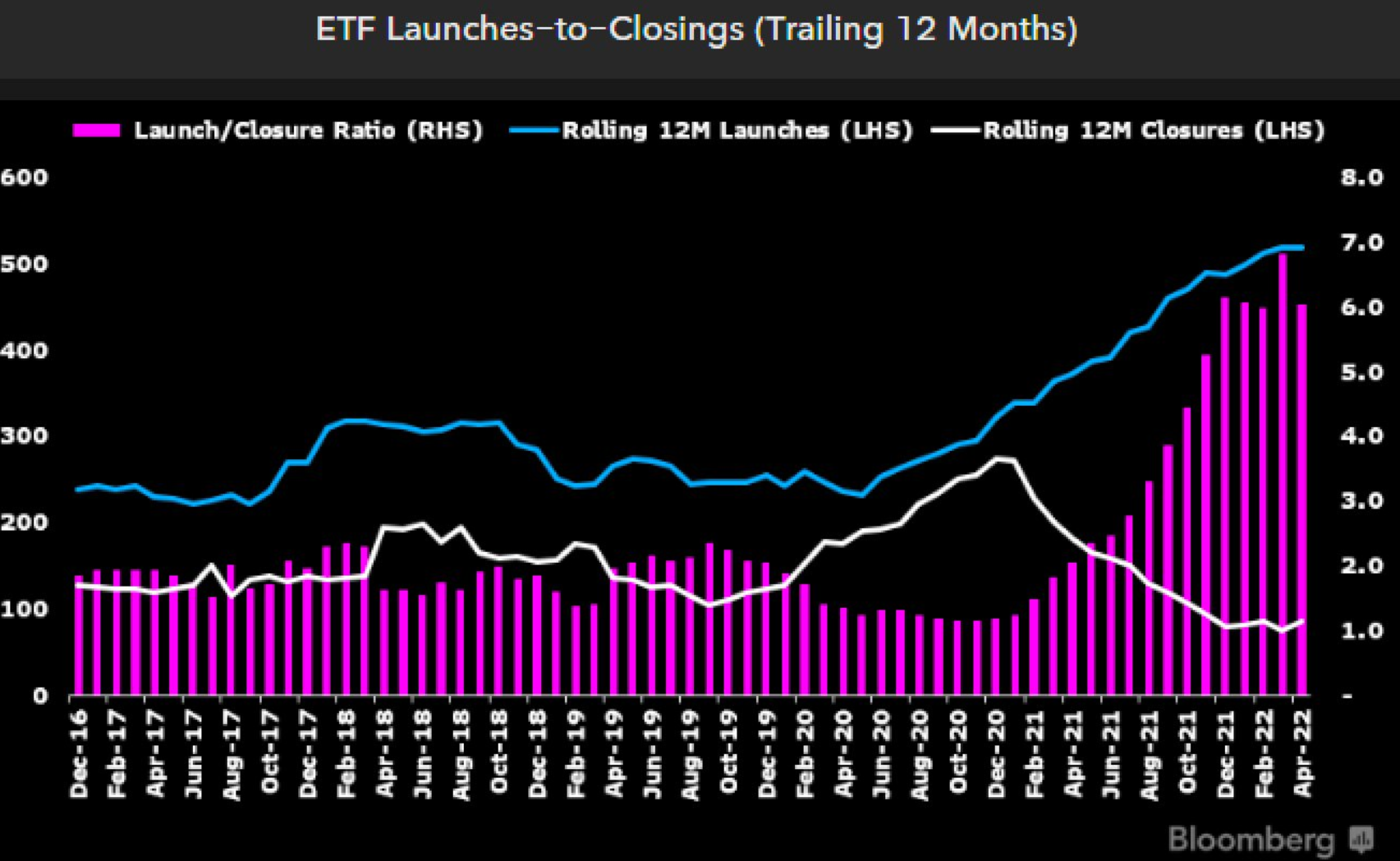

For now, some of the frenzied growth of the past couple of years appears to be cooling off, if only momentarily. Bloomberg senior ETF analyst Eric Balchunas said the ETF “launch-a-thon” is slowing as closures creep upwards, however, he warned the current launch-closure ratio of six to one is “still off the charts”.

Source: Bloomberg Intelligence

Related articles