European fund managers failed to capitalise on the increased opportunities made by the heightened volatility seen at the end of Q1.

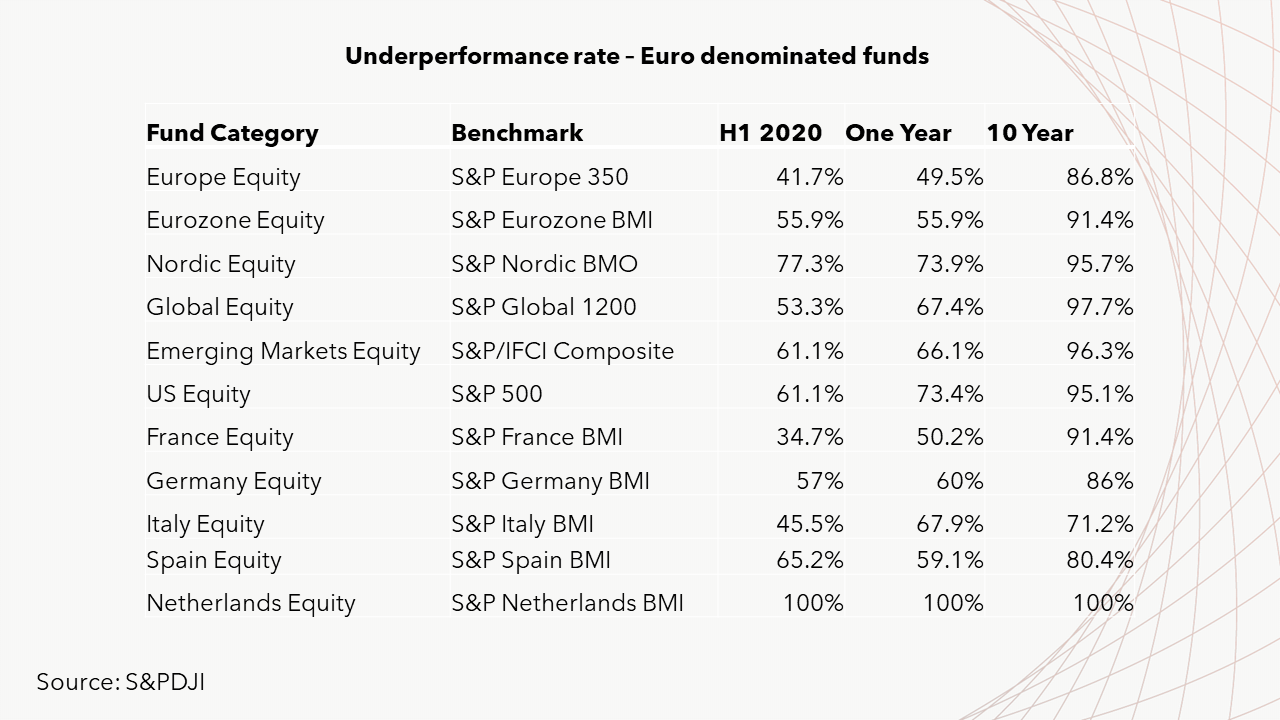

According to S&P Down Jones Indices’ SPIVA 2020 Mid-Year Europe Scorecard, some 53.3% of active eurozone managers underperformed the S&P Eurozone BMI in H1 while 53.3% of global equity managers failed to beat the S&P Global 1200.

It was a similar story for US equity managers with 61.1% failing to beat the notoriously efficient S&P 500.

However, there were some improvements for active European and UK managers with 58% beating the S&P Europe 350.

The S&P Europe 350’s performance in H1 was -12.4% with the average asset-weighted fund within the same category producing a return of -10.6%.

Over longer timeframes, this figure climbed to 49.5% over the last 12 months and 87% over the past 10 years.

The S&P Europe 350’s performance in H1 was -12.4% with the average asset-weighted fund within the same category producing a return of -10.6%.

There was also a significant difference between the 75th and 25th percentile funds for this period. Across Europe, the dispersion rate was 8.1% at the end of H1 while the rate for the 10-year period was 3.2%.

This highlights how the performances of funds varied considerably in periods of volatility when it is usually suggested active managers can produce outperformance.

Andrew Innes, head, global research and design, EMEA, at SPDJI, commented: “As the S&P Europe 350 experienced its highest levels of volatility since the 2008 Global Financial Crisis and the largest single-month drawdown in almost 20 years, the widely held belief that market volatility should create widespread opportunities for active managers remained unproven.”

Nonetheless, the survival rate of these funds was relatively unchanged compared to previous years, with 98% of European equity funds surviving the first six months of 2020.

SPIVA Europe scorecard: Active UK equity funds outperform while other managers struggle

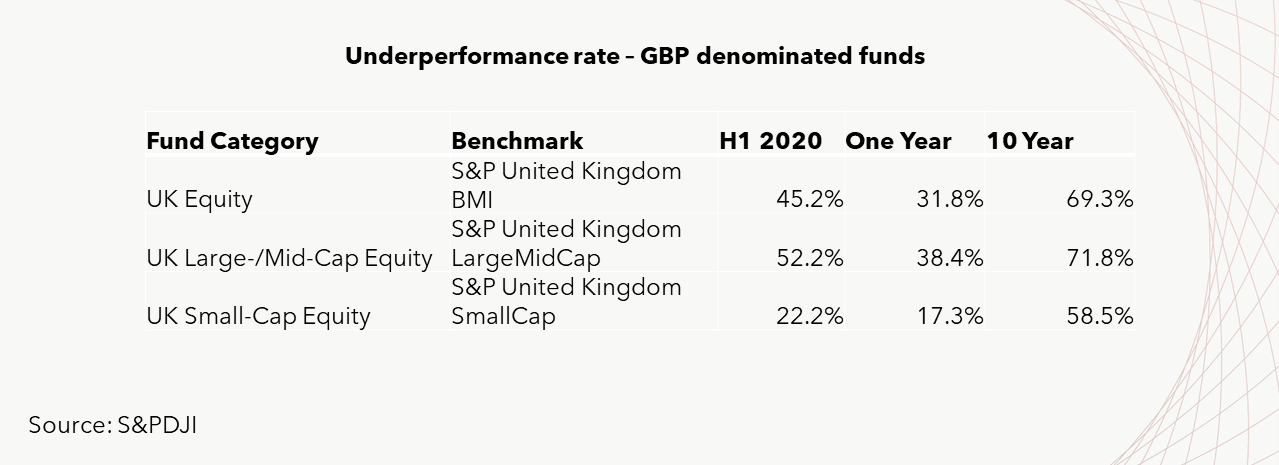

Furthermore, the UK equity category highlighted how size does matter. Some 78% of small-cap funds outperformed their benchmarks with only 48% mid/large-cap funds managing to do the same.

While 42% of European-focused equity funds underperformed, international strategies did even worse. For emerging market equity, global equity and US equity categories, 61%, 53% and 61% of funds underperformed, respectively.