Although there is some debate about the terminology and categorisation of smart beta strategies, there is general agreement that broad investor interest dates back to the collapse of the 'dot com bubble' in the 2000-2002 period.

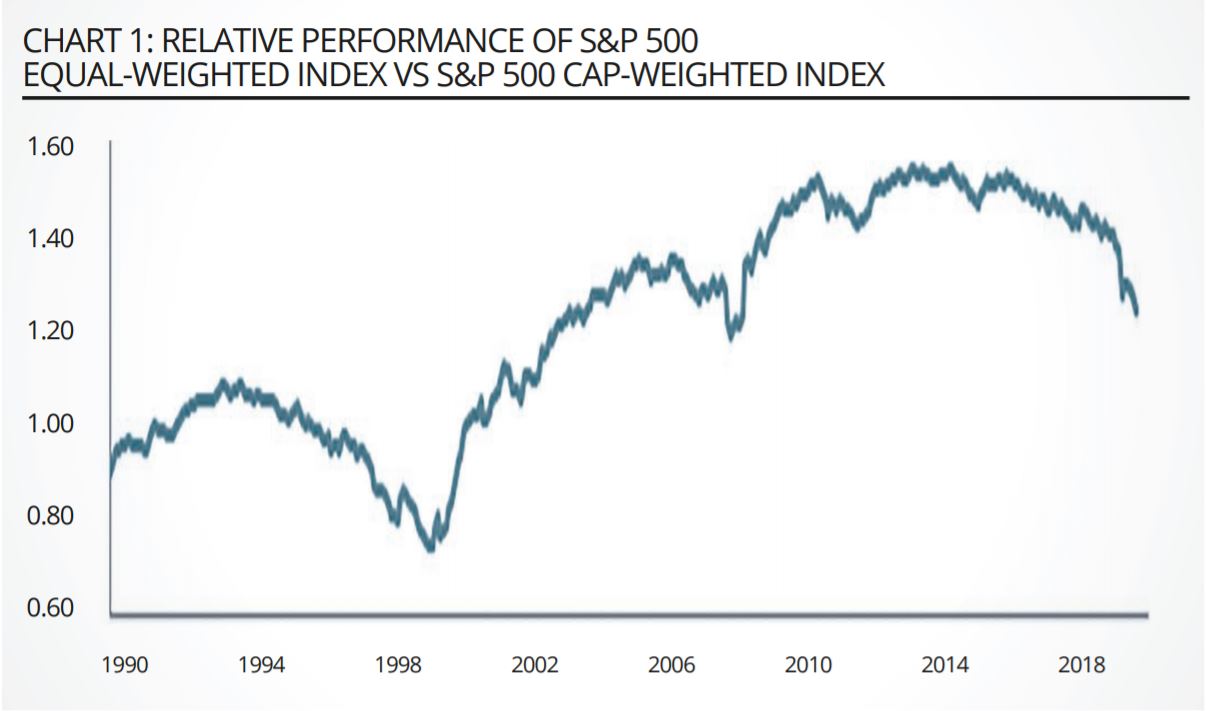

The disproportionate impact of the sharp postbubble correction of stocks in the technology, media and telecommunication sectors (“TMT”) on market-capitalisation weighted indices led investors to consider alternative weighting schemes including equal-weighted indices that were deemed to have better risk-return characteristics (see Chart 1).

Source: Parala Capital

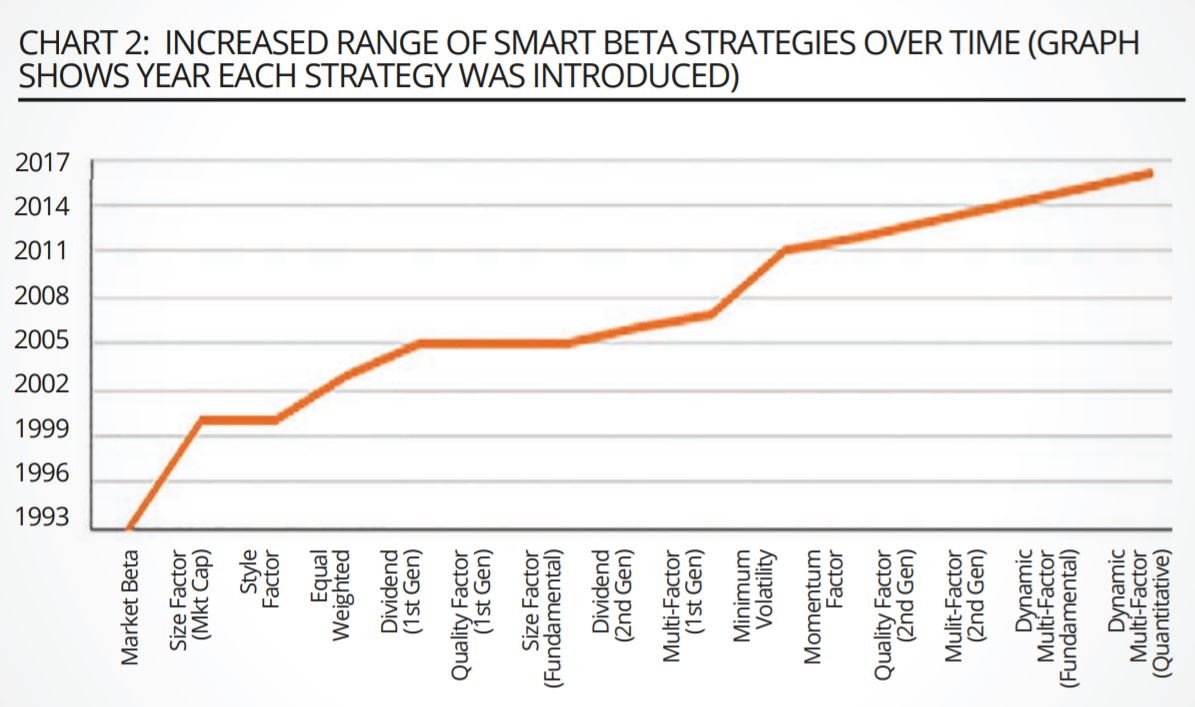

As studies later showed, implicit in different weighting schemes and, at times, key to their outperformance, was exposure to style factors such as small size and value. These first-generation products, with their different weighting schemes, were deemed limiting as their construction methods did not allow for explicit linkage to risk factors. With that knowledge, more recently, the definition and range of smart beta strategies has broadened to include a whole set of rules-based strategies that provide engineered exposure to certain risk factors that have been identified by academics to provide higher returns than the market portfolio (see Chart 2).

Source: Parala Capital

Why do investors find smart beta strategies so attractive?

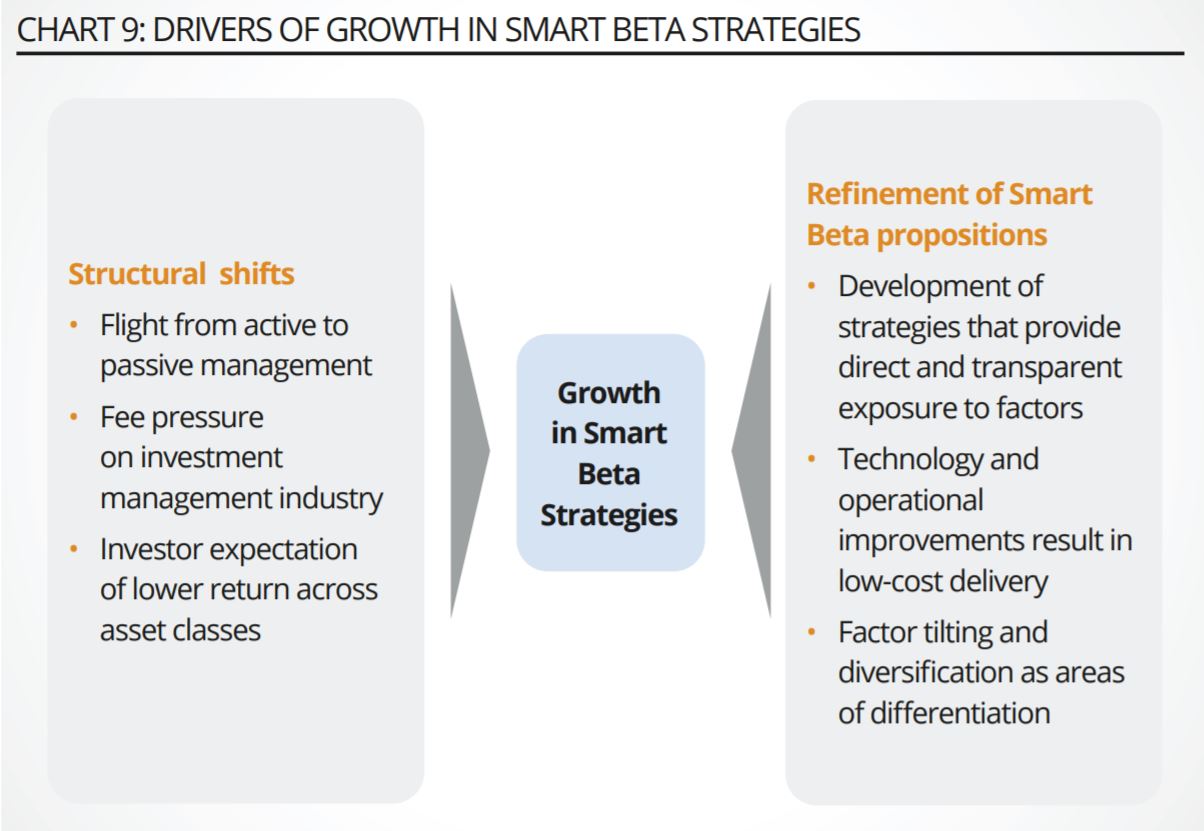

Structural shifts and refinement of the smart beta proposition has made these strategies very attractive to investors. The investment management industry is going through a disruptive period.

This has been brought about by several structural changes including the following:· An unprecedented and accelerating shift from active to passive management due to the sustained underperformance of active managers· A low expected return environment· The search for innovative strategies that can produce incremental returns with a greater degree of certainty (or at least lower cost) than traditional active strategies

As far back as 1949, Benjamin Graham in his seminal book The Intelligent Investor had the following to say about active management:

We would be less than frank, as the euphemism goes, if we did not at the outset express grave reservations on this score. At first blush the case for successful selection appears self-evident. To get average results – e.g., equivalent to the performance of the DJIA – should require no special ability of any kind. All that is needed is a portfolio identical with, or similar to, those thirty prominent issues. Surely, then, by the exercise of even a moderate degree of skill – derived from study, experience, and native ability – it should be possible to obtain substantially better results than the DJIA.

Yet there is considerable and impressive evidence to the effect that this is very hard to do, even though the qualifications of those trying it are of the highest. The evidence lies in the record of the numerous investment companies, or “ funds,” which have been in operation for many years.

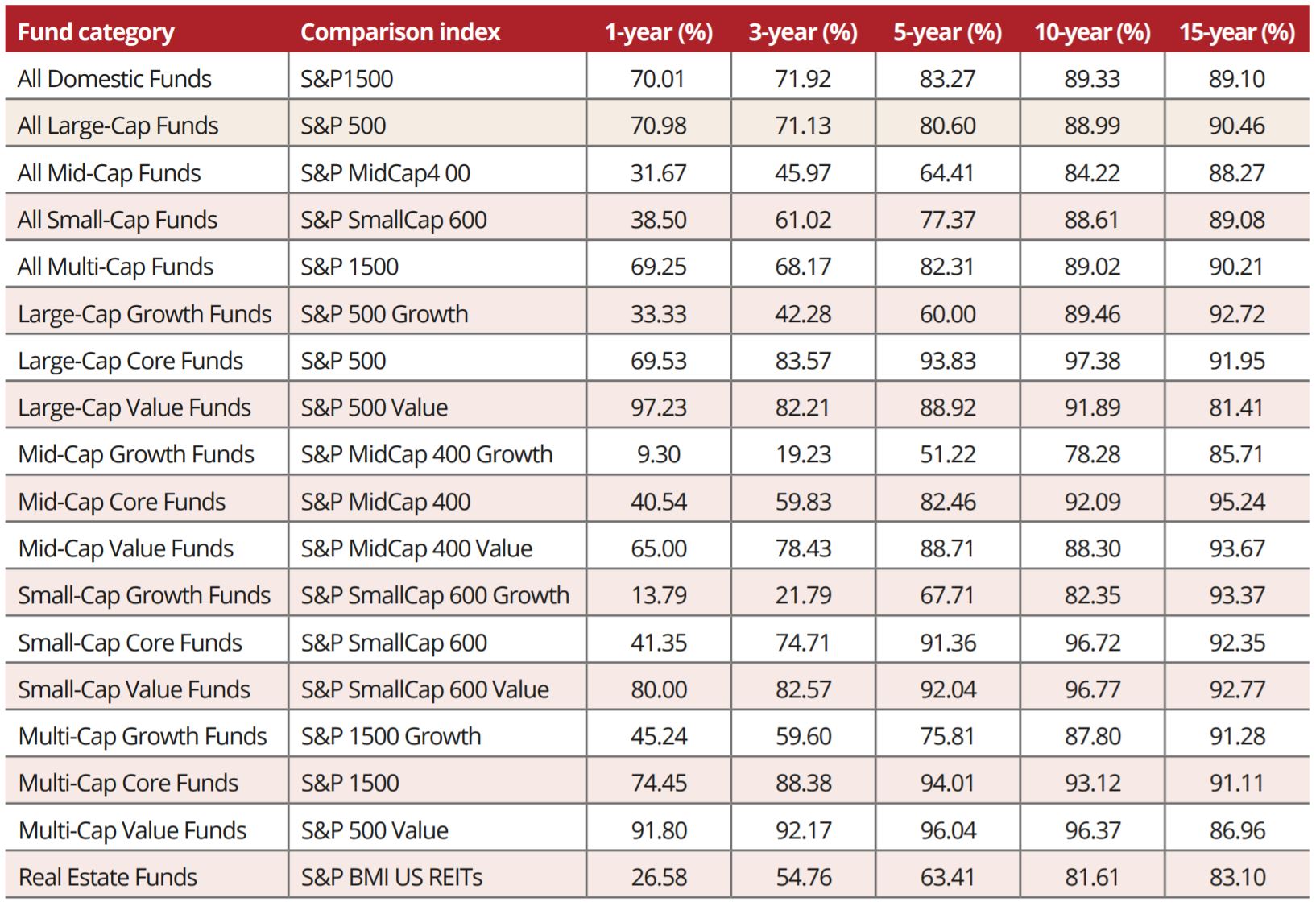

Graham, arguably the first factor investor, was as intelligent and right on this score as he was on so many other tenets of investing and empirical evidence continues to suggest that traditional active managers have lived up to his expectations (see table below).

Source: Parala Capital

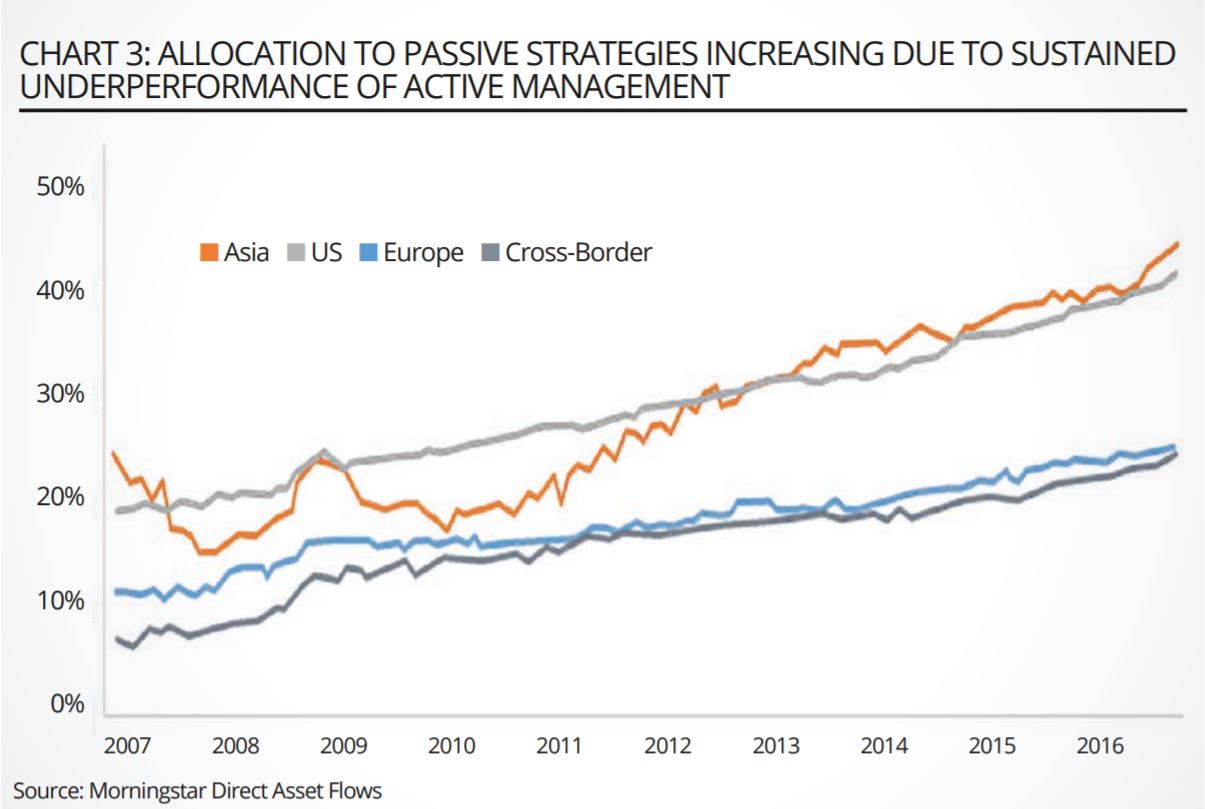

What has changed since the days of Benjamin Graham is that investors are finally beginning to vote with their feet and are aggressively shifting assets into passive strategies (see Chart 3).

Even though traditional active managers, particularly those investing in equities, had historically failed to deliver alpha on a consistent – or any – basis, the shift to passive has inevitably led to the rationalisation of expected returns through diminished expectations of alpha.

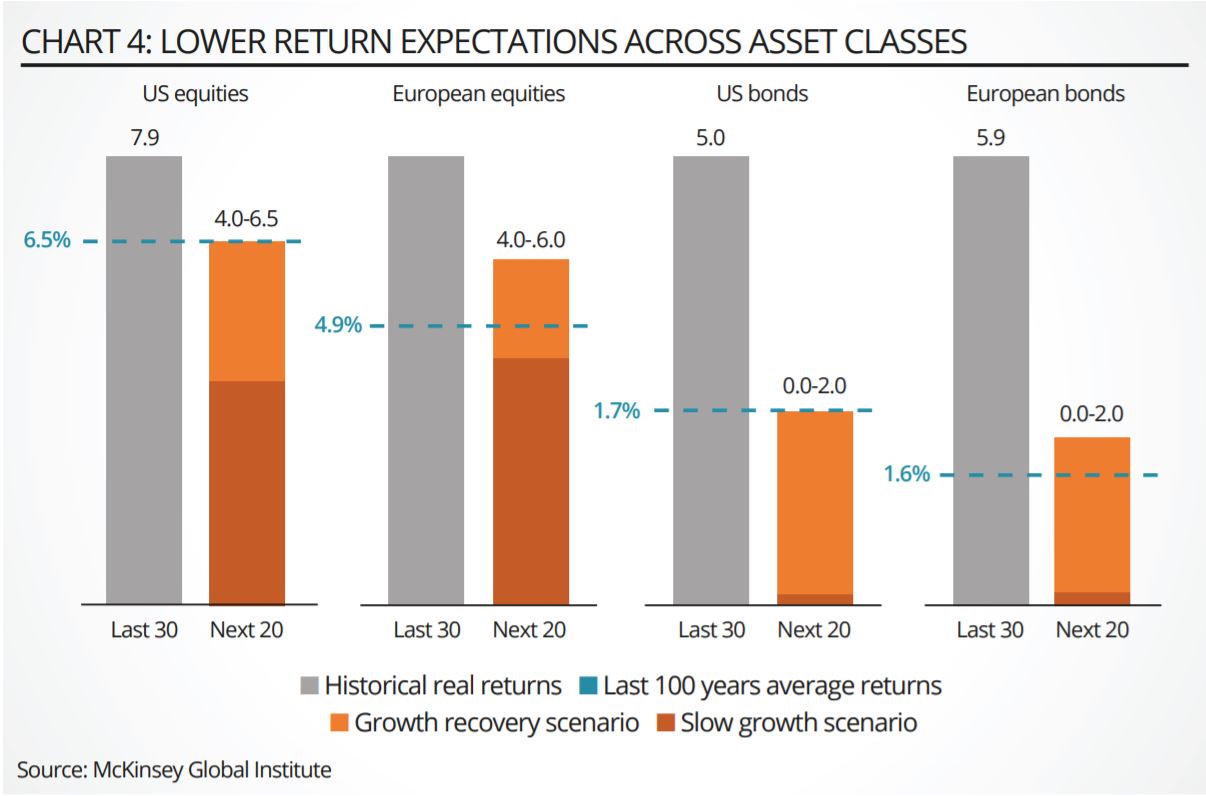

This has been compounded by the combination of slow economic growth, low inflation, high equity valuations and historically low bond yields reducing return expectations across asset classes (see Chart 4).

In response, investors are increasingly looking to diversify into a range of alternative investment strategies and in particular are looking for innovative strategies that can deliver incremental returns with a higher degree of certainty, or at least lower costs, than traditional active managers.

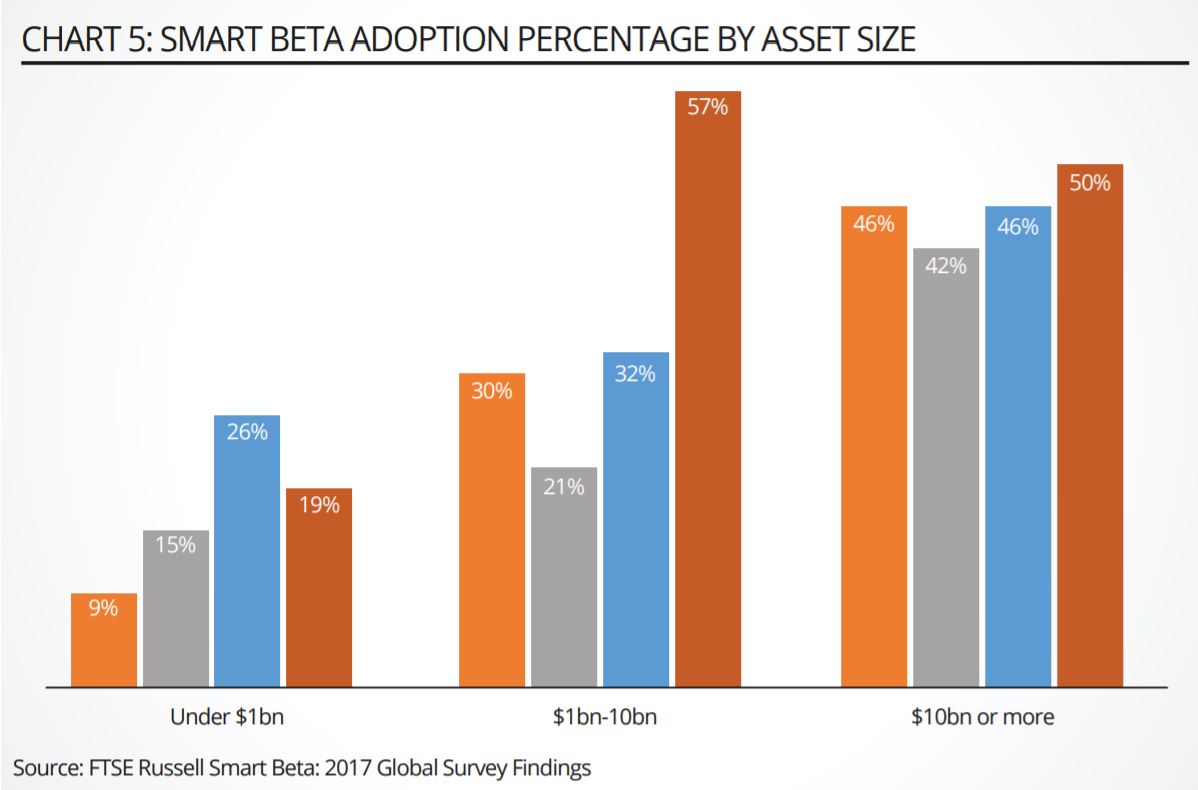

Unsurprisingly in this environment, an extensive body of research showing that factor exposures have been the biggest determinant of active manager performance and that idiosyncratic risk has gone unrewarded, has resulted in the development of smart beta strategies that provide low-cost and direct exposure to factors with associated risk premia, being perceived as the panacea for investors (see Chart 5).

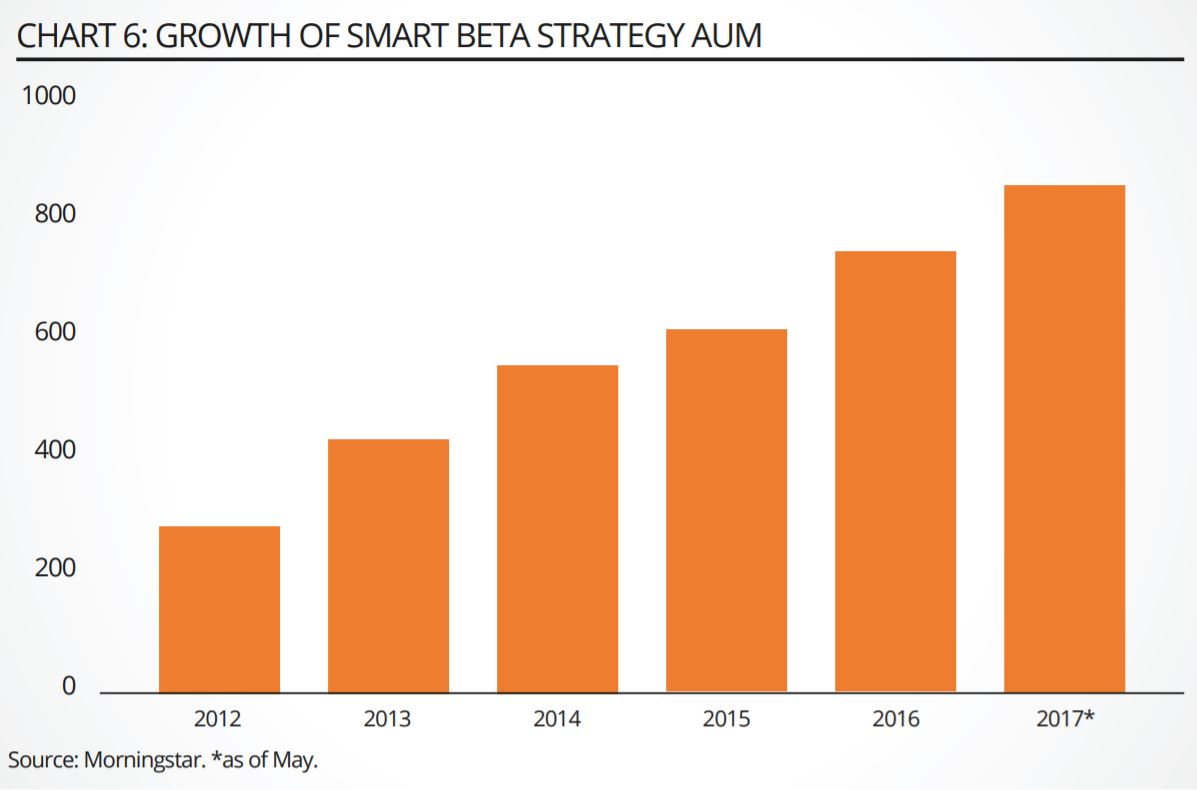

And asset managers who have borne the brunt of the shift towards passive through lower margins have been more than happy to oblige with an evergrowing range of smart—and not so smart offerings that are attracting substantial assets (see Chart 6).

Why invest in smart beta strategies?

Smart beta or factor-based investments, which systematically differ from the market portfolio, are attractive to investors because they allow investors to take on undiversifiable risk and receive a premium for doing so.

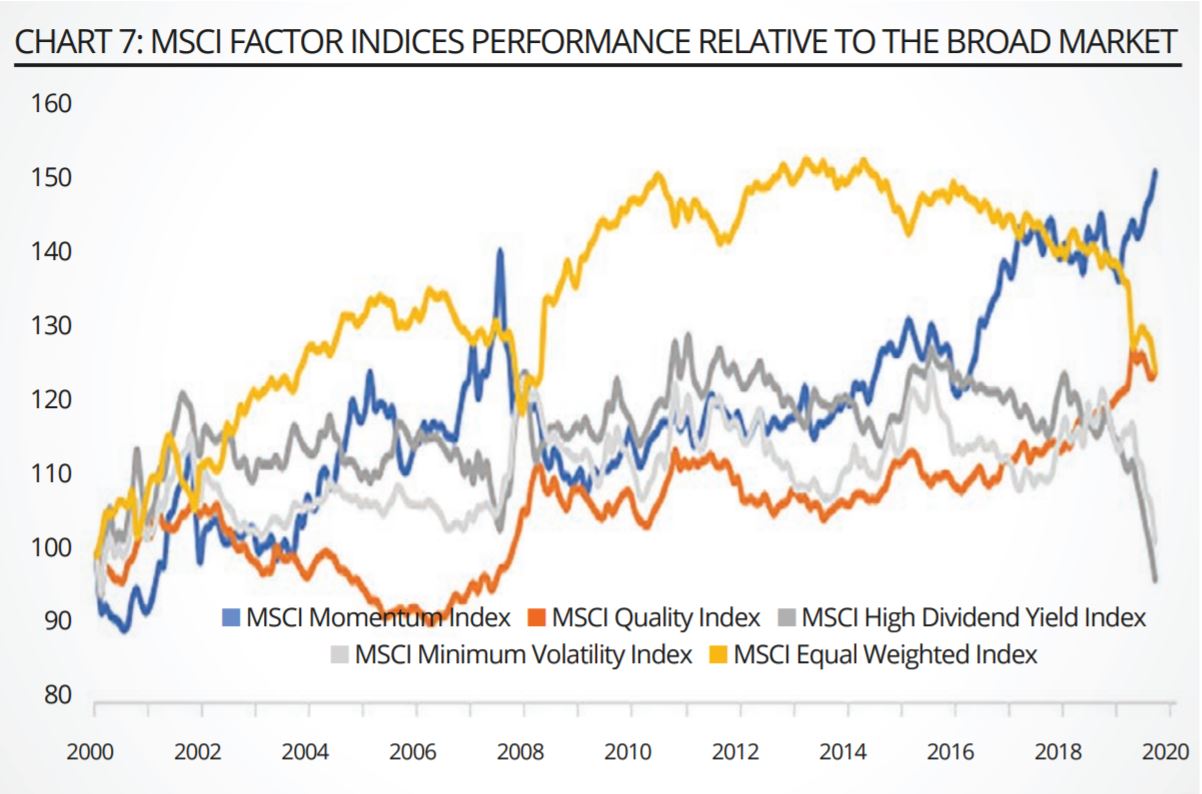

Even though these premiums are not a “free lunch” in that they may go through lengthy periods of underperformance versus the market, the expectation, generally based on academic studies, is that they will outperform the market (see Chart 7).

Unlike market-capitalisation weighted approaches, smart beta investments are dynamic as portfolio constituents and weights must be adjusted to maintain securities in the portfolio with shared characteristics like small size, value and momentum.

There is no consensus in terms of the construction of these strategies with some being faithful to the original academic constructs and others taking liberties with not only the choice of factors but the optimal construction of the underlying index to provide the exposure. The degree of tilt to a factor and the general diversification of the indices are areas of key differentiation.

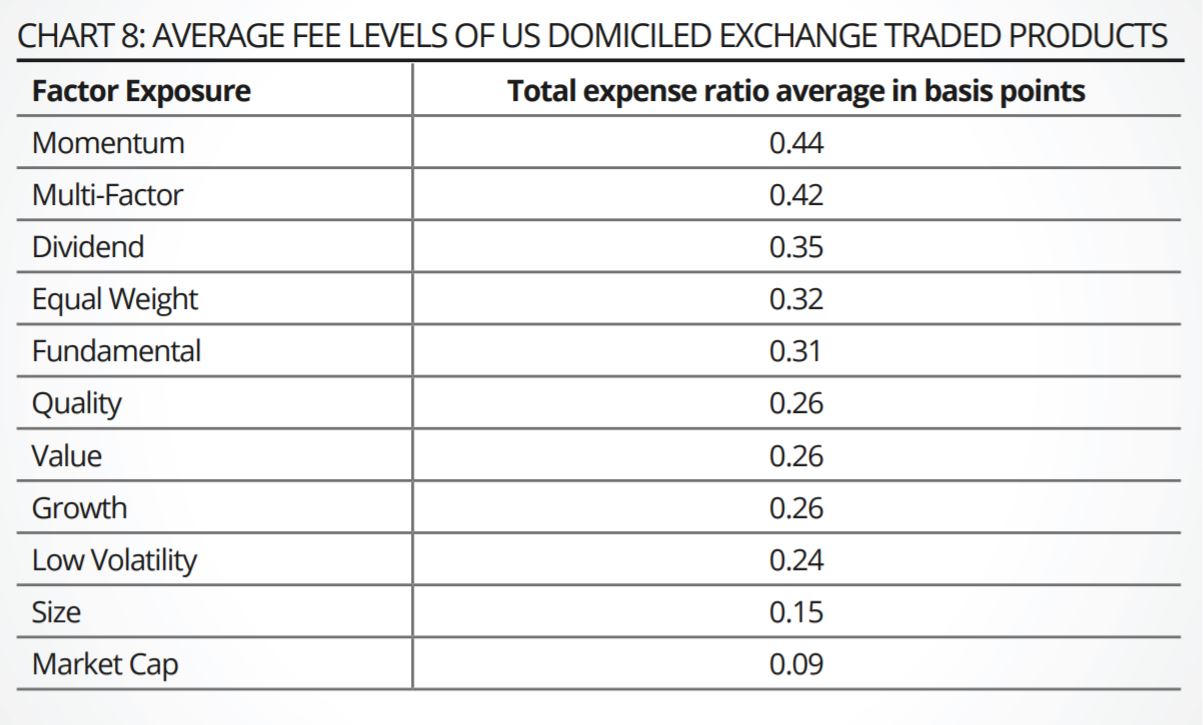

What the strategies share is that their construction methods are rules-based and due to improvements in technology, operational efficiencies, and limited requirements for gathering proprietary information through teams of analysts, they can be delivered at low cost to investors (see Charts 8 and 9).

It is this combination of academic pedigree, return expectations which are higher than the market portfolio and low fees that has driven investor interest and fuelled the growth of the sector.

Similarly, product providers are attracted by the potential of these strategies to allow them to protect their franchises from the onslaught of passive strategies, or if they have strong passive management franchises, to increase their average fees.

Where to?

Smart beta strategies are an innovative response to structural developments in the asset management industry and even though they are still a tiny fraction of the over $71 trillion of AUM by financial institutions, they are one of the fastest growing segments and here for the long-term. For those considering these strategies, which seems to be a substantial cross-section of retail and institutional investors globally, the following principles should provide guidance.

It is paramount to consider smart beta strategies as being active strategies and to apply at least the same rigour in selection as that applied to the selection of traditional active managers and strategies.

If structured appropriately, factor risk premiums can be reaped over the long-term but may be out of favour for extended periods; investors and their advisors need to have the conviction through rigorous analysis and selection processes that the appropriate set of factors and implementation strategies have been selected.

With roots based in academia, investors should only consider those providers that have successfully bridged the gap between an intellectual exercise and practical implementation. Apart from the choice of factors, which is critical, real life considerations such as the impact of trading costs, liquidity of the underlying holdings and portfolio diversification criteria will have great impact on the final outcome, which may end up being very different from results in studies and backtests.

Approach to factor selection, portfolio construction, risk management and attribution reporting should be holistic. The proliferation of strategies and fundamental differences in design and execution, mean that the standard investment analysis tools available in the market may no longer be sufficient for investors with substantial and long-term exposure to factor risk.

Smart beta strategies are only building blocks to use for building diversified portfolios. It is therefore important that investors only consider these strategies if they have the advanced toolkits that can provide sophisticated risk management and attribution analysis which ensure alignment of aggregate portfolio exposure and risks to their expectations and desired outcomes.

Cost should not be the only consideration for product selection. The science of data analysis, portfolio construction and risk management is evolving rapidly. Advances in using big data and applying adaptive learning techniques to financial analysis to deal with uncertainty is gradually moving into the mainstream.

Citi: The concept of smart beta has run its course

If investors accept that smart beta strategies are a variation of active management, they should spend the time and effort to identify the best of breed providers that can genuinely make a difference to their long-term outcomes.

Steven Goldin is managing partner and co-CIO at Parala Capital

This article first appeared in the Q3 2020 edition of Beyond Beta, the world’s only smart beta publication. To receive a full copy,click here.