On 11 April 2000, the first two exchange-traded funds (ETFs) based on the Euro Stoxx 50 and the Stoxx Europe 50 were listed on Deutsche Boerse in Germany. With this listing, Merrill Lynch International brought a product to Europe that had been established in the US in 1993. In addition to Germany, the trading of ETFs also began in Sweden, Switzerland and the UK over the course of the year 2000.

Even as the first reactions to these new products were positive, no one at the time expected the future success ETFs would experience. The following is a summary of major developments for European ETFs over the past two decades.

2001

The first year after launch was rather quiet as far as the trading and the listing of new products. This changed over the course of 2001 as State Street Global Advisors launched the first sector ETFs which enabled European investors to speculate on the different sectors of the MSCI Europe for the first time by overweighting or underweighting specific sectors in their portfolios.

In addition, investors could use these products as a proxy to implement exposure to a specific sector within their portfolio without the need to select single stocks. Also, the French ETF promoter Lyxor launched the first so-called synthetic ETF that used a swap to track the risk/return profile of the underlying Euro Stoxx 50 index.

2003

With the launch of the first bond ETF in 2003, Indexchange, which is now a part of BlackRock, enabled investors to buy specific bond markets with a single security.

By looking at the assets under management, I would assume these products did not meet the expectations of the ETF issuer, as investors were at that time more focused on equities since the equity markets had started to rally again after the tech bubble burst earlier in the decade.

2004

As more and more investors, especially in the institutional segment, used ETFs in their portfolios, the demand for access to new markets increased.

As a result, issuers launched the first emerging markets equity ETFs, as well as ETFs investing with a geographical focus in real estate investment trusts (REITS) over the course of the year.

2005

The first strategy ETFs were launched by Lyxor in Europe. These products enabled investors for the first time to implement a specific investment strategy with an ETF.

The new strategies ranged from leveraged long strategies to covered-call strategies. In addition to this, EasyETF – a joint venture of AXA Investment Managers and BNP Paribas Asset Management – launched the first commodities ETF.

Even as the trend towards smart beta or factor investing ETFs started years later in approximately 2012, the first ETFs that enabled investors in Europe to capture risk premia from different factors were launched in 2005 when Lyxor launched the first ETFs to capture the small cap, growth, and value premia, while BlackRock launched the first ETF with a dividend strategy.

2006

Commodities ETFs started to become a success when ZKB launched the first ETFs on gold, silver and platinum which were fully backed by specific precious metals in 2006. These products were not only fully backed, but also exchangeable – the investors could claim for physical delivery of the metal.

2007

At this point, the only missing asset type in the ETF segment was money markets. This gap was closed in 2007 when DWS launched an ETF on the EONIA money market index. In the wake of the upcoming Global Financial Crisis (GFC), these products immediately found favour with investors in Europe.

In addition to this, the range of strategy ETFs was expanded by so-called short strategies – ETFs that enable investors to take advantage of decreasing equity markets.

We also witnessed the launch of new strategies in the bond and alternatives sectors, as the first ETFs using credit spreads as well as currency pairs as underlying hedges were introduced. In addition, Lyxor launched the first ETF with a multi-factor strategy (RAFI).

This year also marked the first major corporate action since the German ETF issuer Indexchange, then part of Hypovereinsbank, was bought by Barclays Global Investors (BGI) and renamed Barclays Global Investors (Deutschland) later during the year while the respective ETFs were renamed with the iShares branding (the ETF brand of BGI).

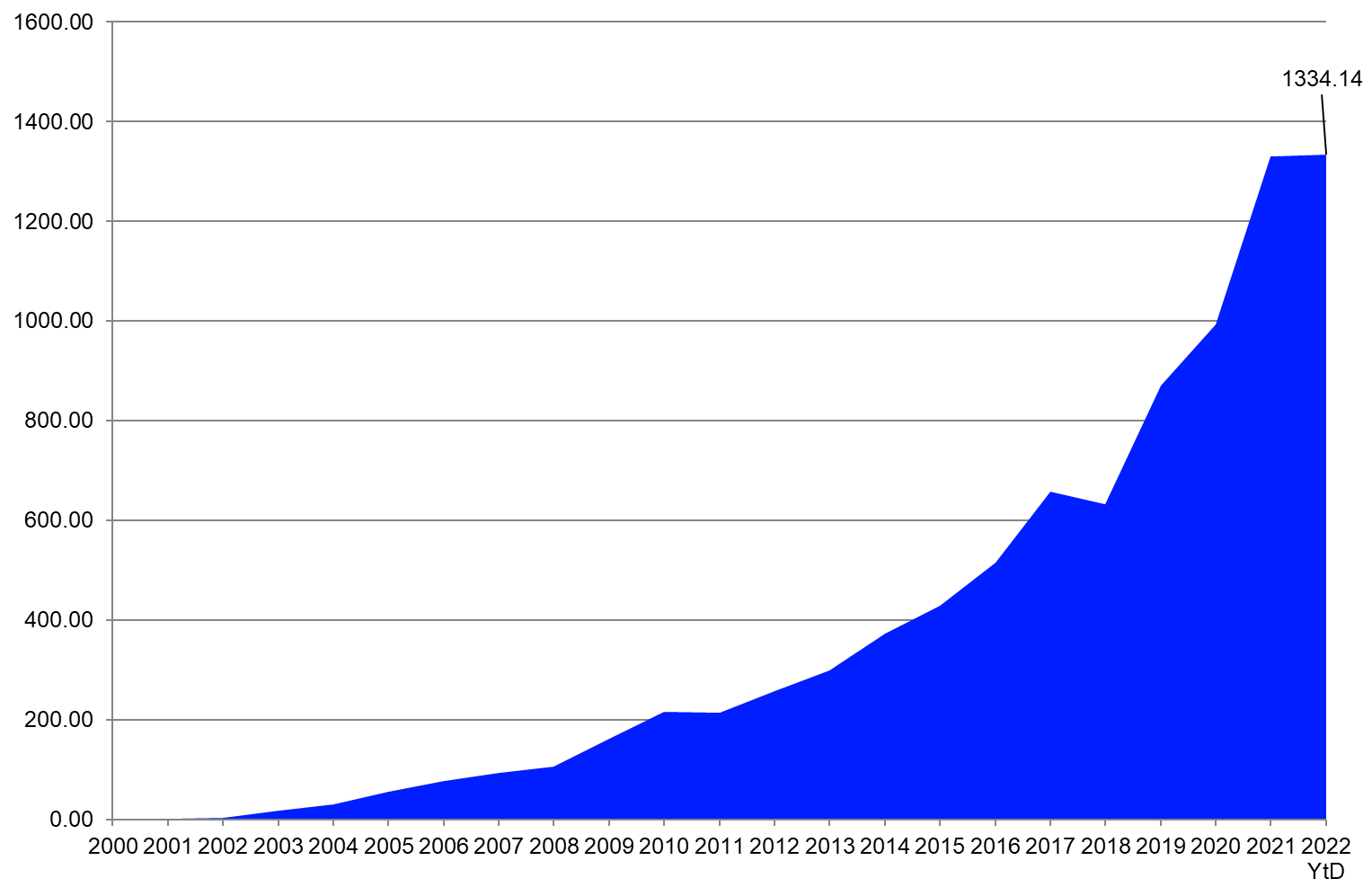

Graph 1: AUM in the European ETF Industry (30 April 2000-31 March 2022)

Source: Refinitiv Lipper

2008

As a result of the increasing popularity of ETFs in Europe, AUM hit the €100bn mark for the first time in April 2008.

Even as the trend toward mixed-assets products was not in place in 2008, we witnessed the launch of the first mixed-assets ETF by DWS during the tough market environment of the GFC.

The increased popularity of ETFs was shown by the fact that ETFs enjoyed inflows over the course of the year while mutual funds faced heavy outflows.

2009

In 2009, DWS launched the first ETF that invested in hedge funds. Even as this segment is lacking in transparency and is highly illiquid, the respective ETF showed the same intraday liquidity as all ETFs. With regard to this, investors did not have to deal with the issues arising from the limited liquidity of a hedge fund when they used this product. Even as Marshall Wace and UBS also launched ETFs with hedge fund indices as underlying in 2010, these products have so far not gathered a lot of interest from European investors.

This year also marked the second major corporate transaction in the industry, as the US asset manager BlackRock bought BGI, the asset management arm of Barclays Bank. This deal included iShares and created the world’s largest asset manager.

2010

On 1 June 2010, the European ETF industry witnessed the launch of the thousandth ETF. Some 65 of these 1000 ETFs have been closed between April 2000 and June 2010. Overall, 436 of the 1000 ETFs are still active, as at the end of December 2021. These ETFs were accounting for €476.5 bn – or 35.8% – of the overall AUM of the European ETF industry.

2011

During the market turmoil of the euro crisis in 2011, ETFs were once again the product type of choice of investors in Europe, as they again showed inflows, while their actively managed peers suffered heavy outflows. With regard to this, it seems that European investors prefer ETFs over actively-managed funds in times of market turmoil.

In the aftermath of the euro crisis, European ETF issuers started to launch bond funds that enabled investors to invest in specific segments of the bond markets. The opportunity to avoid or to take the risk from specific market segments or use these ETFs as proxies for single bonds – for example, avoiding the risk from a single bond by buying a basket of bonds with the same or very similar provisions – led to very dynamic growth for bond ETFs overall.

2012

The next step to enhance the coverage of ETFs focused on asset classes and investment themes were taken by Lyxor in 2012, as the French issuer launched the first ETF that enabled investors to use the S&P 500 VIX Futures index in their portfolios.

In May 2012, the global pioneer of index investing Vanguard entered the European ETF market with the launch of five UCITS ETFs.

2013

The year 2013 started with a big bang with the fourth-largest issuer of ETFs in Europe, Credit Suisse Asset Management, announcing in January that it had sold its ETF business to BlackRock, which integrated the Swiss ETF platform as a local offering into its iShares product offering.

2015

The US ETF promoter VanEck launched its first two UCITS-compliant ETFs, listed in London, seven years after the firm opened its first European office.

2016

In 2016, the assets under management in the European ETF industry surpassed €500bn, ending the year with overall assets under management of €514.5bn.

2017

The takeover of Source by its rival Invesco in April 2017 marked the next major corporate action in the European ETF segment, as the eighth-largest ETF issuer in Europe got bought by the sixteenth largest ETF promoter.

Later in the year, Hector McNeil and Nik Bienkowski founded the ETF white-label platform HANetf. While white-label platforms have been established in the mutual funds space for a long time, HANetf is the first white-label platform in the ETF space. This launch shows that the whole ETF ecosystem is advancing while the industry is maturing.

This year ended as it started with Legal & General Investment Management (LGIM) announcing the acquisition of the Canvas platform from ETF Securities in November.

The success of the European ETF industry raised a lot of interest from the promoters of mutual funds who looked at ETF market entry as a way to enhance their success. As such, the market entry of Fidelity, Franklin Templeton, and JP Morgan Asset Management was not surprising, since these asset managers were already involved in the US ETF market.

Nevertheless, the entry of active asset managers into the ETF market has the potential to become a game-changer for the whole asset management industry.

2018

Since all major asset classes and markets were already covered by ETFs, it is not surprising that ETF launch activity has shifted from a focus on plain vanilla indices to sectors, market segment, or trends. This activity was fuelled by the demand for ESG products as well as demand for specific market sectors in the bond and equity segments.

In July 2018, Société Générale acquired ComStage, the ETF arm of German lender Commerzbank to consolidate the position of its ETF arm Lyxor as one of the leading ETF issuers in Europe and to reinforce its presence in Germany, one of the key markets for ETFs in Europe.

In addition, promoter VanEck bought the Dutch ETF issuer Think ETF to broaden its ETF portfolio for the European and international markets.

2019.

On January 16, 2019, the global ETF industry received the sad news that the father of index investing Jack Bogle had died at the age of 89. Bogle founded Vanguard in 1974 and created the “First Index Investment Trust” in 1976. This mutual fund was the first index mutual fund available to the general public. Bogle’s idea for this fund was that instead of beating the index and charging high costs, the index fund would mimic the index performance over the long run – therefore achieving higher returns with lower costs than the costs associated with actively managed funds.

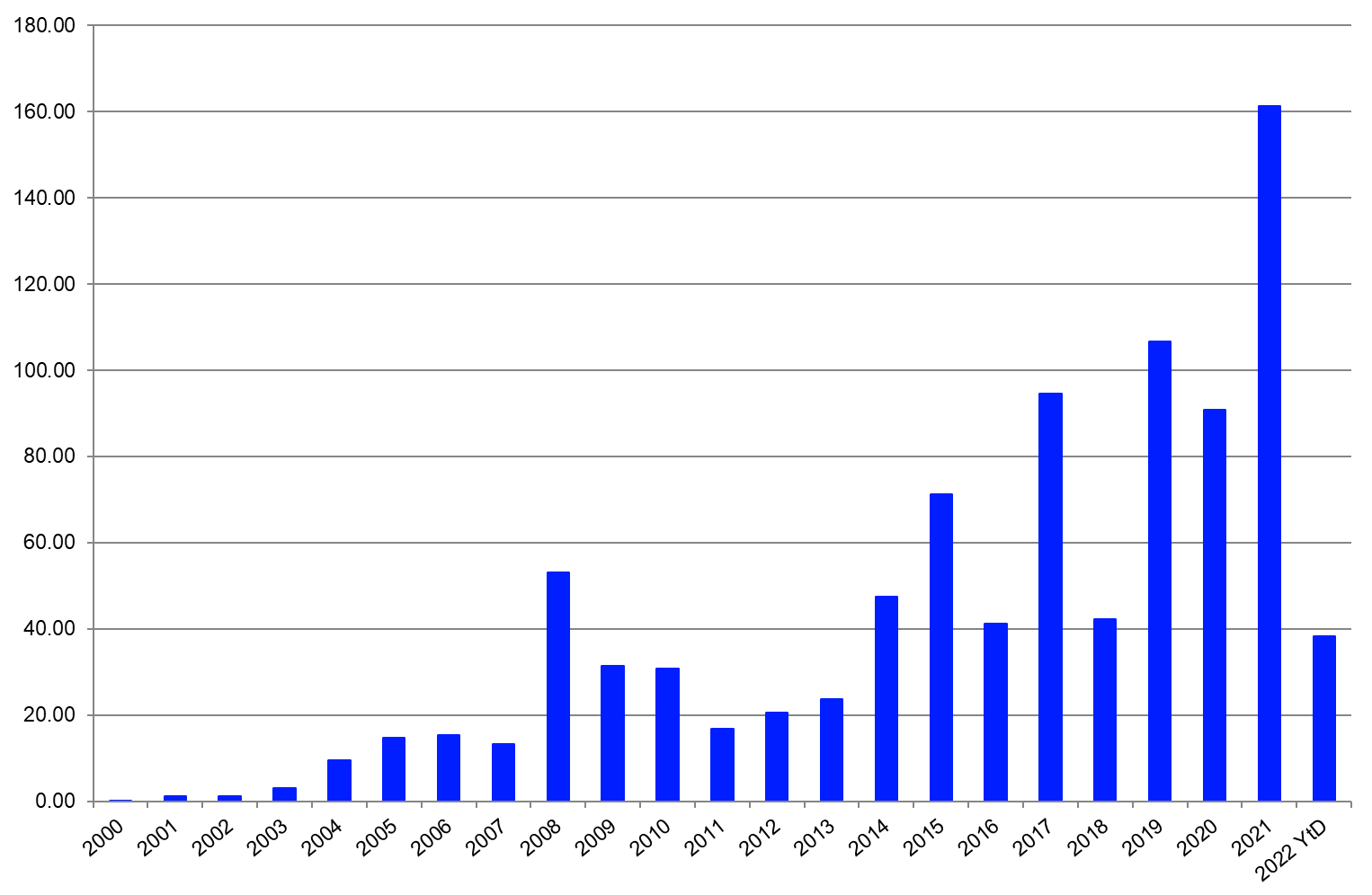

With net inflows of €106.7bn, the European ETF industry enjoyed inflows of more than €100bn for the first time in history. Additionally, AUM reached €870bn at the end of the year, which marked a new all-time high.

2020

The year 2020 started with volatile market conditions as the coronavirus put the world in lockdown mode, which may lead to the roughest recession since the 1930s. This being the case, 2020 has the potential to become the first year with net outflows since the inception of ETFs in Europe.

In March 2020, Credit Suisse AM made its return as an issuer in the European ETF industry with the launch of three UCITS ETFs domiciled in Ireland.

2021

As the year 2021 started, the European ETF industry hit the next milestone as the AUM in ETFs reached more than €1trn at the end of January 2021. While it took the European ETF industry 16 years to gather the first €500bn in assets under management, the promoters of ETFs needed only five years to double that amount. These numbers depict the dynamic growth pattern of the European ETF industry.

In June 2021, Amundi acquired rival Lyxor from SocGen. This transaction came shortly after Lyxor finished the integration of ComStage and shuffled the league table of the largest ETF issuer in Europe around taking Amundi to the new second-largest ETF issuer in Europe.

Chart 2: Flows in the European ETF market (11 April 2000-31 March 2022)

Source: Refinitiv Lipper

At the end of 2021, the European ETF industry hit another milestone as the annual inflows into ETFs in Europe (€161bn) topped the €150bn mark for the first time in history.

Detlef Glow is head of Lipper EMEA Research at Refinitiv, a London Stock Exchange business

Related stories