The iShares Core MSCI Japan IMI UCITS ETF USD (IJPA) saw the most inflows across all ETFs listed in Europe last week after the US and Japan agreed a trade deal earlier this month.

According to data from Ultumus, investors poured $479m into IJPA in the week to 18 October, over $100m more than the ETF which saw the second most inflows.

The inflows come just weeks after US President Donald Trump and Japan President Shinzo Abe signed a final trade agreement.

The trade deal is expected to eliminate or lower tariffs on a number of agricultural and digital products.

In the press conference after, Trump stated: “We are at a stage with Japan where our relationship has never been better than it is right now.”

ETF issuers see Japanese retail market as next big opportunity

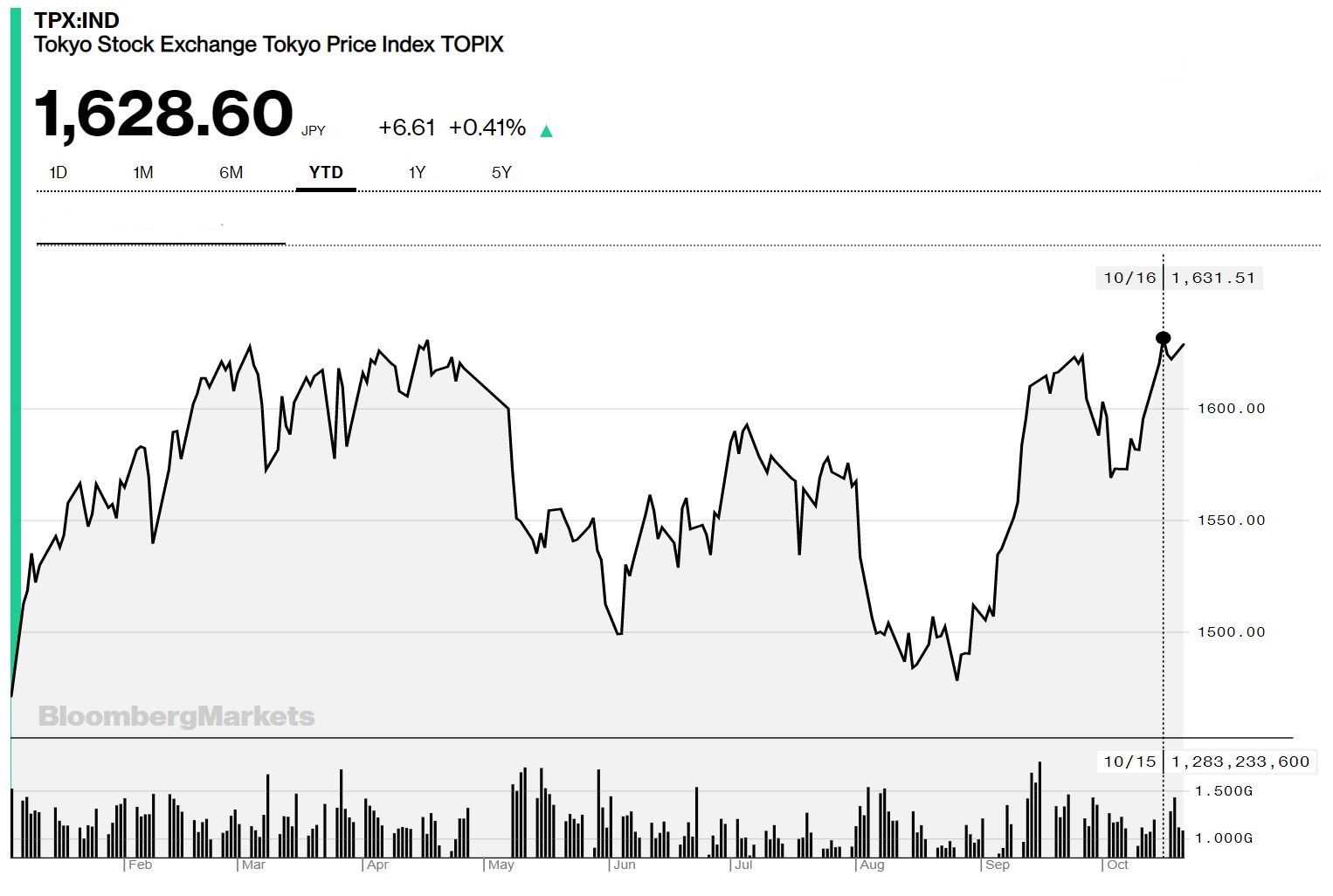

Following the deal, the Topix index hit a 10-month high on 15 October, reaching 1,631 points for the first time since December.

Source: Bloomberg

Some investors may be viewing the country as a contrarian play. So far this year, the MSCI Japan is up 11.5%, as of 30 September, versus 18.5% for the MSCI World and it underperformed the broader market by 4.4% in 2018.

Furthermore, last month, value investor Michael Burry, who shot to fame for betting against the US housing market in the lead-up to the Global Financial Crisis in Michael Lewis’ book The Big Short, revealed he is targeting small and mid-cap Japanese companies.

Elsewhere, investors also were gaining exposure to the broad fixed income market with the Vanguard Global Aggregate Bond UCITS ETF and the iShares Core Global Aggregate Bond UCITS ETF seeing $154m and $120m inflows last week.